-

Coordinación de beneficios (COB)

La disposición de coordinación de beneficios (COB) se aplica cuando una persona tiene cobertura de atención médica en más de un plan. Las normas de determinación del orden de beneficios rigen el orden en que cada plan pagará un reclamo de beneficios. El plan que paga primero se denomina plan principal. El plan principal debe pagar los beneficios según los términos de su póliza sin tener en cuenta la posibilidad de que otro plan cubra algunos gastos. El plan que paga después del plan principal es el plan secundario. El plan secundario puede reducir los beneficios que paga para que los pagos de todos los planes no superen el 100 % del gasto total admisible.

* Renuncia de responsabilidad: La coordinación de beneficios no se aplica a los afiliados en Tennessee.

-

Herramienta de estimación de costos

Desde el 1 de enero de 2023, los planes y los emisores deben poner a disposición la información de comparación de precios respecto de la lista inicial de 500 artículos y servicios identificados. Desde el 1 de enero de 2024, los planes y los emisores deben poner a disposición la información de comparación de precios respecto de todos los artículos y servicios cubiertos. Debe iniciar sesión en el portal para miembros para usar la herramienta de estimación. Haga clic aquí y acceda al portal para miembros.

-

Información de la Explicación de beneficios (EOB)

Una EOB es una herramienta útil para hacer un seguimiento de sus beneficios de atención médica de Ascension Personalized Care. Le muestra cómo su plan médico procesó un reclamo de atención médica. Las EOB se parecen a una factura, pero funcionan diferente. La EOB tendrá el formato de una carta que incluye un cuadro en el que se muestra cómo se tramitó su reclamo. Siempre revise su EOB y asegúrese de que la información que aparece sea correcta. Si falta información o tiene dudas sobre su EOB, comuníquese con el número de servicio de atención al cliente que está atrás de su tarjeta de identificación de miembro.

Consulte la siguiente lista de elementos clave incluidos en su EOB:

- Nombre del paciente: Asegúrese de que su nombre o el nombre de otra persona cubierta por su plan médico se muestren en la EOB.

- Número de identificación del asegurado: Este debe coincidir con el número de su tarjeta de identificación de miembro.

- Número de reclamo: El número con el que usted y su plan médico podrán referirse a un reclamo si tienen preguntas o preocupaciones.

- Proveedor: El nombre del proveedor de atención médica que ofrece este servicio. Este podría ser el nombre de un médico específico o de un hospital u otro centro.

- Fecha del servicio: La fecha de inicio y finalización del servicio.

- Tipo de servicio: Una descripción del servicio que recibió.

- Cargo del proveedor de atención médica: La cantidad facturada a su plan médico por el proveedor de atención médica.

- Costo cubierto por su plan médico: El total que su plan médico pagó por sus servicios.

- Lo que usted debe: Cualquier saldo facturado por el proveedor de atención médica que no esté cubierto por su plan médico.

-

Archivos legibles por máquina

Para cumplir la legislación de Transparencia en la cobertura, los planes de seguros están obligados a generar archivos legibles por máquina disponibles para las tarifas dentro de la red (para médicos de la red del plan) y para tarifas fuera de la red (para médicos que no están en la red del plan). Seleccione el archivo deseado para obtener más información.

Atención: Estos archivos contienen una gran cantidad de datos y pueden necesitar varios minutos para descargarse/abrirse.

Tarifas dentro de la red para noviembre de 2023: Indiana

Tarifas dentro de la red para noviembre de 2023: Kansas

Tarifas dentro de la red para noviembre de 2023: Michigan

Tarifas dentro de la red para noviembre de 2023: Tennessee

Tarifas dentro de la red para noviembre de 2023: Texas

-

Necesidad médica y autorización previa

Una autorización previa es una aprobación de su plan médico. Es posible que se exija antes de que pueda surtir una receta o recibir un servicio médico. Llámenos al 844-995-1145 para obtener una autorización previa.

La revisión de autorización previa se hace para confirmar la necesidad médica, según se define en su póliza, de un entorno, servicio, tratamiento, suministro, dispositivo o medicamento con receta. Si un entorno, servicio, tratamiento, suministro, dispositivo o medicamento de venta con receta está en la lista de abajo, se debe obtener la revisión de la autorización previa antes de incurrir en cualquier reclamo por ese entorno, servicio, tratamiento, suministro, dispositivo o medicamento de venta con receta. Usted es responsable de obtener la revisión de la autorización previa cuando se necesite. Puede obtener la revisión de la autorización previa comunicándose con nosotros a:

Seton Health Plan Medical Management

1345 Philomena St., Suite 305

Austin, TX 78723

Teléfono: 844-995-1145

Fax: 512-380-7507

Correo electrónico: SHP-Authorization@ascension.org

La autorización previa no es una garantía de que los beneficios serán pagados. Todos los beneficios a pagar dependerán de los términos, las condiciones, las disposiciones, las exclusiones y las limitaciones de la póliza.

Los siguientes entornos, servicios, tratamientos, suministros, dispositivos o medicamentos con receta necesitan una revisión de la autorización previa:

- Ingresos de pacientes hospitalizados (incluidos cuidados agudos, cuidados agudos a largo plazo, rehabilitación médica del comportamiento o los trastornos por abuso de sustancias,

tratamiento residencial y hospitalización parcial; centros de enfermería especializada) - Ingresos de emergencia en un plazo de 48 horas siguientes al ingreso

- Maternidad de alto riesgo (periódica que supera los requisitos federales)

- Procedimientos quirúrgicos para pacientes ambulatorios

- Procedimientos orofaríngeos

- Procedimientos de columna vertebral

- Radiología diagnóstica

- Radiología terapéutica

- Evaluación neuropsicológica

- Ortótica y prótesis

- Equipo médico duradero (incluidos los artículos de DME de más de $1000)

- Dispositivos auditivos (EAR)

- Trasplantes (que no sean de córnea)

- Atención médica en casa

- Terapia de infusión en casa

- Terapia ambulatoria de rehabilitación y habilitación

- Medicamentos inyectables (administrados por un médico de atención médica)

- Pruebas genéticas

* Tratamiento, pruebas o procedimientos experimentales o de investigación potenciales

* La lista de servicios que requieren una revisión de la autorización previa no es exhaustiva

Si no se usan o no se acatan las decisiones del Programa de Administración de utilización, se denegará el reclamo por no haber autorizado previamente el procedimiento o el ingreso propuesto. Renuncia de responsabilidad: Debido a las reglas del Departamento de Seguro de Texas, los miembros de Texas recibirán una reducción de los beneficios hasta del 50 % del cargo admisible.

- Ingresos de pacientes hospitalizados (incluidos cuidados agudos, cuidados agudos a largo plazo, rehabilitación médica del comportamiento o los trastornos por abuso de sustancias,

-

Presentación de reclamos de miembros

Los médicos dentro de la red del plan de Ascension Personalized Care presentan reclamos para los miembros después de que reciben los servicios. Los formularios de reclamo solo pueden ser enviados a Ascension Personalized Care por médicos para miembros de Ascension Personalized Care.

Para comunicarse con el servicio al cliente, llame al 833-600-1311.

-

Reclamaciones, quejas formales y apelaciones de miembros: médico

Disponemos de medidas para solucionar cualquier problema relacionado con el seguro que pueda tener. Para que esté satisfecho, aportamos procesos para presentar apelaciones o reclamaciones. Tiene derecho a presentar una reclamación, a presentar una apelación y a pedir una revisión externa. Esperamos que siempre esté conforme con nuestros médicos y con nosotros. Pero si no lo está, o no logra encontrar respuestas a sus preguntas, disponemos de medidas que puede seguir:

- Proceso de solicitud de información

- Proceso de reclamación

- Proceso de queja formal

- Proceso de apelación

- Revisión externa por parte de una organización de revisión independiente (IRO)

- Reclame al departamento de seguros de su estado: Kansas Insurance Department, Indiana Department of Insurance, Tennessee Department of Commerce and Insurance o Texas Department of Insurance

Su conformidad es muy importante para nosotros. Queremos saber qué problemas y preocupaciones tiene para poder mejorar nuestros servicios. Llame al equipo de Servicio de Atención para Miembros al 833-600-1311 de lunes a viernes, de 8:00 a. m. a 6:00 p. m. (EST), TTY: 586-693-1214 o envíe un correo electrónico a apcsupport@ascension.org. Intentaremos responder a sus preguntas durante el contacto inicial, ya que la mayoría de las preocupaciones pueden resolverse con una sola llamada telefónica. Están disponibles los siguientes procesos para responder a sus preocupaciones:

Cómo presentar una solicitud de información

Una solicitud de información es un pedido de aclaración de un beneficio, un producto o una elegibilidad en la que no se expresa insatisfacción. Algunos ejemplos de solicitud de información:- Cómo hacer un pago

- Cómo encontrar un médico o cambiar el proveedor de atención primaria

- Preguntas sobre facturación

- Preguntas sobre primas

- Cómo encontrar la identificación de los miembros

Cómo presentar una reclamación

Una reclamación es una expresión oral de insatisfacción. Algunas reclamaciones se pueden resolver con un llamado telefónico. Algunos ejemplos incluyen:

- Duración de una consulta con el médico

- No encuentro un médico o no aceptan pacientes nuevos

- Varias interacciones con el servicio al cliente y el problema sigue sin resolverse

- Problemas para inscribirse en el sitio web

- Necesito ayuda para encontrar información en el sitio web

- El médico o el personal fueron groseros

Para presentar una reclamación, llame al Servicio de Atención para Miembros al 833-600-1311 de lunes a viernes, de 8:00 a. m. a 6:00 p. m. (EST), TTY: 586-693-1214. Para obtener una lista completa de definiciones, consulte la Evidencia de cobertura.

Cómo presentar una queja formal

Una queja formal se refiere a cualquier insatisfacción con una aseguradora que tiene un plan de beneficios de salud o con la administración de un plan de beneficios de salud por parte de la aseguradora, expresada verbalmente o por escrito en cualquier forma a la aseguradora por parte o en nombre de un demandante, incluida cualquiera de las siguientes opciones:- Prestación de servicios

- Determinación para rescindir una póliza

- Determinación de un diagnóstico o nivel de servicio necesario para el tratamiento basado en la evidencia de los trastornos del espectro autista

- Prácticas de reclamo

- Cancelación de su cobertura de beneficios con nosotros

Los ejemplos de quejas formales son:

- La receta genérica no tenía el copago genérico aplicado

- El procedimiento preventivo no tenía una cobertura del 100 %

- Necesito que un coordinador de casos se comunique conmigo en relación con la atención médica en casa

- Inconvenientes con el consentimiento

- Reacción alérgica al medicamento recetado

- Preocupaciones con la cobertura del plan

Para presentar una queja formal, llame al Servicio de Atención para Miembros al 833-600-1311 de lunes a viernes, de 8:00 a. m. a 6:00 p. m. (EST), TTY: 586-693-1214.

Puede presentar una queja formal de manera verbal o por escrito por correo o correo electrónico a apcsupport@ascension.org. Si necesita ayuda para presentar una queja formal o si no es capaz de presentarla por escrito, puede llamar al Servicio de Atención para Miembros al 833-600-1311 (TTY: 586-693-1214) para pedir ayuda durante el proceso. Le enviaremos una carta de acuse de recibo de su queja formal después de haberla recibido.

Envíe su formulario de queja formal por escrito a:

US Health and Life Insurance Company

PO Box 1707

Troy, MI 48099-1707Queja formal acelerada: si las preocupaciones de su queja formal son una emergencia o una situación en la que usted pueda verse forzado a dejar el hospital antes de tiempo, o si un proceso de resolución estándar pudiera poner en riesgo grave su vida, su embarazo o su salud.

Queja formal estándar: una queja formal que no cumple la definición de una queja formal acelerada.

Consulte la Evidencia de cobertura para conocer todos los procedimientos y procesos de reclamación, incluida la información específica de presentación y los plazos. Puede acceder a su Evidencia de cobertura en su cuenta de miembro en línea. También puede presentar una queja formal con el Departamento del Seguro.

Cómo presentar una apelación

Una apelación es pedida para reconsiderar una decisión sobre los beneficios de un miembro, donde se negó un servicio o un reclamo. Una denegación incluye una solicitud para que reconsideremos nuestra decisión de denegar, modificar, reducir o cancelar el pago, la cobertura, la autorización o la prestación de servicios o beneficios de asistencia médica, incluidos el ingreso o la estancia en un centro de asistencia médica. La no aprobación o denegación de una solicitud de autorización previa en tiempo y forma puede considerarse como una denegación y está sujeta al proceso de apelación. Ejemplos de una apelación:- Acceso a los beneficios de la atención médica, incluida una determinación adversa hecha según la administración de la utilización

- Ingreso o estancia en un centro de atención médica

- Pago de reclamos, manejo o reembolso de servicios de atención médica

- Asuntos asociados con la relación contractual entre un miembro y Ascension Personalized Care

- Cancelación de la cobertura de beneficios

- Otros asuntos exigidos específicamente por la ley o la reglamentación estatal

Para presentar una apelación por escrito, puede enviarnos su solicitud por correo o correo electrónico:

US Health and Life Insurance Company

PO Box 1707

Troy, MI 48099-1707

apcsupport@ascension.org

Los plazos de resolución pueden variar según el tipo de apelación presentada. Consulte la Evidencia de cobertura para obtener información.

Apelación acelerada: Si las preocupaciones de la apelación son una emergencia o una situación en la que usted pueda verse forzado a dejar el hospital antes de tiempo, o si cree que un proceso de resolución estándar pudiera poner en riesgo grave su vida, su embarazo o su salud.

Apelación estándar: una apelación que no cumple la definición de una apelación acelerada.

Cómo pedir una revisión externa

Una vez que se hayan agotado todos los métodos de apelación descritos arriba y que están disponibles en este plan médico, puede pedir una revisión externa del Departamento de Seguros del estado. Usted o su representante autorizado enviarán una solicitud por escrito para esta revisión externa con los formularios necesarios que le dimos al departamento del estado donde vive. El departamento determinará si su solicitud califica para una revisión acelerada y, si lo hace, ellos o nosotros (según las leyes de su estado) podemos asignarla a una organización de revisión independiente (IRO).

Cuando presente una revisión externa según este plan médico, no estará sujeto a represalias por ejercer este derecho; se le permite usar la asistencia de otras personas, incluidos médicos o proveedores de atención médica, abogados, amigos y familiares durante todo el proceso de revisión; se le permite enviar más información relacionada con el servicio propuesto durante el proceso de revisión; y debe colaborar con la IRO dando cualquier información médica que se le pida o autorizando la revelación de cualquier información médica necesaria.La IRO hará una revisión y dará su recomendación al departamento. El departamento le dará la decisión en un plazo de 72 horas para una revisión externa acelerada después de que se presente su solicitud de revisión externa; o en los 15 días posteriores a la presentación de una solicitud de revisión externa después de una apelación estándar. La decisión que tome el departamento será definitiva según la Ley del Derecho del Paciente a una Revisión Independiente del año 2000.

Escriba al estado correspondiente mencionado abajo para pedir una revisión externa según se describió arriba; o para presentar su reclamación:

Miembros en el estado de Indiana:

State of Indiana Department of Insurance

Consumer Services Division

311 West Washington Street

Suite 300

Indianapolis, IN 46204

Línea directa del consumidor: 800-622-4461 o 317-232-2395

En línea: in.gov/idoi/consumer-services/

Attn: Consumer Insurance Services

Miembros en el estado de Kansas:

Kansas Insurance Commissioner

Kansas Insurance Department

1300 SW Arrowhead Road

Topeka, KS 66604

Teléfono: 785-296-3071 or 800-432-2484

Miembros en el estado de Tennessee:

500 James Robertson Pkwy, 10th Floor

Nashville, TN 37243

Teléfono: 800-342-4029 o 615-741-2218

En línea: tn.gov/commerce/insurance/consumer-resources/file-a-complaint.html

Miembros en el estado de Texas:Texas Department of Insurance (TDI)Teléfono: 888-834-3476 o 512-322-3400 (área de Austin)

-

Reclamaciones, quejas formales y apelaciones de miembros: medicamentos con recetaLa política nacional de apelaciones de

MaxorPlus’ consiste en un proceso de apelaciones interno de un solo nivel para la resolución de disputas relativas a denegaciones de beneficios cubiertos de necesidad médica antes/después del servicio, así como denegaciones de cobertura de los beneficios después del servicio. Si un asunto no se puede resolver rápidamente antes de la apelación, se puede iniciar un proceso de apelación interna formal por escrito, generalmente hasta 180 días calendario desde de la fecha de la última determinación.

En cada caso, MaxorPlus puede tener derecho a una extensión por única vez de no más de 15 días. Las apelaciones aceleradas se realizan en los plazos que exije la normativa vigente a nivel estatal y federal.

Se seleccionan revisores para las determinaciones de apelación de modo que se garantice que ni ellos ni sus supervisores hayan participado en la decisión anterior.

Para presentar una apelación para un medicamento con receta (Rx) a MaxorPlus:

• Complete el Formulario de presentación de apelación para Rx de Ascension Personalized Care.

• Una vez que haya completado el Formulario de presentación de apelación, envíelo por fax al número de abajo:

• Número de fax de apelaciones estándar de Rx APC: 844-370-6203

• Número de fax de apelaciones aceleradas de Rx APC: 844-370-6203

• El Formulario de presentación de apelación se puede enviar por correo a: MaxorPlus Clinical Department 320 S. Polk St., Amarillo, TX 79101

• Si quiere hablar con alguien para consultar el estado de una apelación, el número de teléfono es 888-839-4448

-

Recuperación de sobrepagos de los miembrosLos miembros pueden disputar cargos o pagos de primas comunicándose con el servicio al cliente al 833-600-1311.

-

Falta de pago de prima y período de gracia para créditos fiscales de prima

Los miembros deben pagar todas las primas mensuales a Ascension Personalized Care cuando vencen. Si los pagos se atrasan, Ascension Personalized Care enviará un aviso a los miembros con información sobre cómo mantener la cobertura. Esto incluye pagar todas las primas adeudadas al final del período de gracia como se define abajo.

Para los miembros que no reciben créditos fiscales avanzados para primas (APTC), Ascension Personalized Care da un período de gracia de 30 días para el pago de las primas mensuales (esto no incluye el primer pago de la prima vinculante). La cobertura continuará durante el período de gracia de 30 días. Si Ascension Personalized Care no recibe la cantidad total de la prima adeudada al final del período de gracia, la cobertura se cancelará hasta el último día del período de gracia. Los miembros pueden ser responsables ante Ascension Personalized Care por el pago de la parte de la prima por el tiempo que la cobertura estuvo vigente durante el período de gracia.

Para los miembros que reciben un APTC, Ascension Personalized Care da un período de gracia de 90 días si el miembro ha pagado previamente al menos la prima de un mes completo durante el año de beneficios. Durante el período de gracia, Ascension Personalized Care:

- pagará todos los reclamos correspondientes por los servicios prestados al miembro durante el primer mes del período de gracia y puede suspender (retener) el pago del reclamo por servicios prestados al afiliado en el segundo y tercer mes del período de gracia;

- informará al Departamento de Salud y Servicios Humanos (HHS) tal falta de pago; e

- informará a los médicos la posibilidad de reclamos denegados cuando un miembro esté en el segundo y tercer mes del período de gracia.

Si un miembro que recibe APTC llega al final de su período de gracia de 90 días sin pagar todas las primas pendientes, le informaremos que se cancelará la cobertura. El último día de cobertura será el último día del primer mes del período de gracia de 90 días. Los miembros serán responsables del pago de todos los cargos por reclamos pendientes o pagados durante el segundo y tercer mes del período de gracia.

-

Servicios fuera de la red y facturación de saldo

Para recibir los beneficios de la cobertura, los miembros deben usar un médico de la red. Sin embargo, el pago se hará al nivel de beneficios del médico de la red por los servicios prestados por un médico fuera de la red cuando los servicios se presten por una emergencia médica. Ascension Personalized Care dará al miembro listas de médicos dentro de la red en el área de servicio de Ascension Personalized Care. El miembro es responsable de elegir a sus médicos para los servicios de atención médica.

Para los servicios de emergencia cubiertos, los miembros pagarán el costo compartido dentro de la red (copago, coseguro y deducible). Los miembros también pagarán el costo compartido dentro de la red por los servicios prestados por algunos médicos fuera de la red (como anestesiólogos o patólogos) que prestan servicios en un hospital de la red o si el médico fuera de la red presta ciertos servicios en un hospital o centro de la red y no informa al miembro de su estado fuera de la red. Estos médicos fuera de la red también tienen prohibido facturar al miembro cualquier cantidad que exceda la responsabilidad de costos compartidos del miembro.

-

Excepción de medicamentos con receta y proceso aceleradoLos médicos o miembros pueden solicitar y obtener acceso a un medicamento que no está en el formulario del plan en determinadas situaciones. El médico del miembro puede recomendar un servicio en particular o un artículo aprobado por la FDA en función de una determinación de necesidad médica en relación con esa persona. Para solicitar una excepción, primero se debe denegar el reclamo y luego se puede procesar una apelación de excepción. Según este proceso, informaremos al miembro, al designado del Asegurado y al médico sobre nuestra decisión en el transcurso de las 72 horas después de recibir la solicitud de excepción. El miembro o la persona designada por el miembro/médico pueden solicitar una excepción acelerada según las circunstancias apremiantes y recibir un aviso a más tardar 24 horas después de hacer la solicitud.

El miembro o el médico pueden presentar la solicitud de excepción de medicamentos a MaxorPlus enviando el Formulario de presentación de apelación para Rx por fax al 844-370-6203 o por correo a la dirección que figura en el formulario. Para solicitar una revisión acelerada por circunstancias apremiantes, comuníquese con el departamento de Servicio al Cliente de MaxorPlus al número gratis que figura en la parte de atrás de su tarjeta de identificación para comenzar el proceso.

-

Medicamentos con receta que exigen una autorización previa

La cobertura de ciertos medicamentos con receta y suministros relacionados exige que su médico obtenga autorización antes de recetarlos. La autorización previa puede incluir, por ejemplo, una determinación de terapia gradual. La terapia gradual determina la progresión del uso específico de productos farmacéuticos o suministros terapéuticamente equivalentes apropiados para el tratamiento de una condición específica. Si su médico cree que los medicamentos con receta o los suministros relacionados que no están en la Lista de medicamentos con receta son necesarios, o quiere solicitar cobertura para medicamentos con receta y suministros relacionados para los cuales se exige autorización previa, su médico puede llamar o completar el formulario de autorización previa correspondiente y enviarlo por fax a MaxorPlus para solicitar una excepción a la Lista de medicamentos con receta o una autorización previa para la cobertura de los medicamentos con receta y los suministros relacionados. Su médico debe hacer esta solicitud antes de escribir la receta.

Si se aprueba la solicitud, su médico recibirá la confirmación. La autorización se procesará en nuestro sistema de reclamos para permitirle tener cobertura para esos medicamentos con receta y suministros relacionados. La duración de la autorización dependerá del diagnóstico y los medicamentos con receta y los suministros relacionados. Cuando su médico le informe que se ha aprobado la cobertura de los medicamentos con receta y los suministros relacionados, debe comunicarse con la farmacia para surtir las recetas.

Si la solicitud es denegada, su médico y usted recibirán un aviso de que no se autoriza la cobertura de los medicamentos con receta y los suministros relacionados. Si no está de acuerdo con una decisión de cobertura, puede apelar esa decisión de conformidad con las disposiciones de la póliza, presentando una solicitud por escrito que indique por qué los medicamentos con receta y los suministros relacionados deben estar cubiertos.

Si tiene preguntas sobre una excepción específica de la Lista de medicamentos con receta o una solicitud de autorización previa, debe llamar a Servicio al Cliente al número gratis que figura en la parte de atrás de su tarjeta de identificación de MaxorPlus. Todos los procesos de revisión de terceros están a cargo de Ascension Personalized Care.

-

Plazo de autorización previa

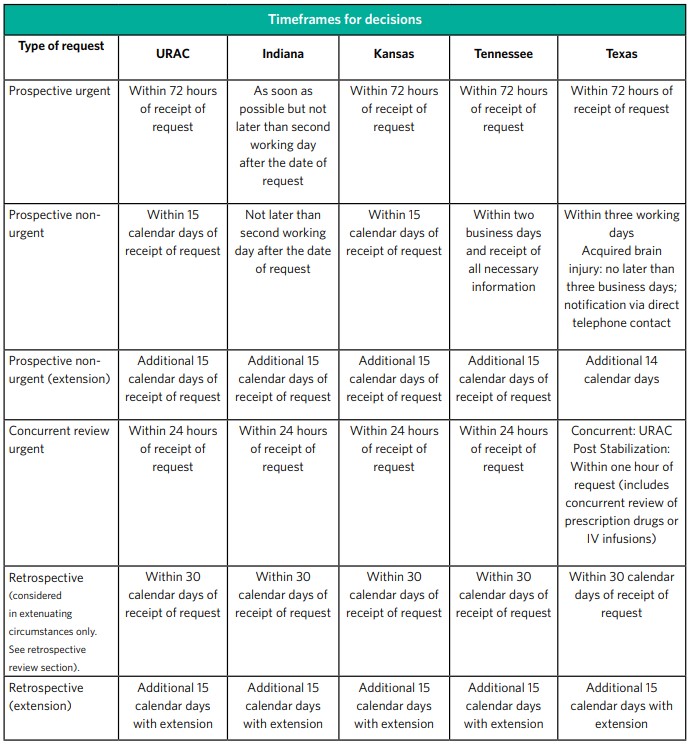

Las determinaciones de certificación previa se hacen de conformidad con los estándares de tiempo de la URAC.

Nota: Si los estándares federales o estatales difieren de los de la URAC, se aplica el estándar de tiempo más estricto.

Determinaciones estándar de la organización

Las determinaciones estándares de la organización se hacen con la mayor diligencia que lo requiera la condición médica del miembro, pero no más de 15 días naturales después de la recepción de la solicitud del servicio. Tenga presente que cuando los estándares de tiempo estatales o federales difieren, se aplica el estándar de tiempo más estricto. Se puede otorgar una extensión de 14 días calendario adicionales si el miembro solicita la extensión o si justificamos que la demora por una necesidad de información y documentos adicionales es para la conveniencia del miembro.

Determinaciones aceleradas de la organización

Las determinaciones aceleradas de la organización se hacen cuando el miembro o su profesional clínico consideran que esperar una decisión según el plazo de tiempo estándar podría poner en grave peligro la vida, la salud o la capacidad de recuperar la función máxima del miembro. La determinación se hará con la mayor diligencia que lo requiera la condición médica del miembro, pero no más de 72 horas desde la recepción de la solicitud del miembro o del profesional clínico. Tenga presente que cuando los estándares de tiempo estatales o federales difieren, se aplica el estándar de tiempo más estricto. Se puede otorgar una extensión de 14 días calendario adicionales si el miembro solicita la extensión o si justificamos que la demora por una necesidad de información y documentos adicionales es para la conveniencia del miembro. Las determinaciones aceleradas de la organización no pueden solicitarse para los casos en que el único problema se relaciona con un reclamo de pago por los servicios que el miembro ya haya recibido. Las solicitudes urgentes aceleradas se pueden hacer a Ascension Personalized Care por teléfono llamando al 844-995-1145.

-

Denegación retroactiva de reclamos

Una denegación retroactiva es la revocación de un reclamo que ya hemos pagado. Si denegamos retroactivamente un reclamo que ya hemos pagado por usted, usted es responsable del pago. Algunas razones por las que podría tener una denegación retroactiva incluyen:

- Tener un reclamo que fue pagado durante el segundo o tercer mes de un período de gracia

- Tener un reclamo pagado por un servicio para el cual no era elegible

Puede evitar las denegaciones retroactivas pagando sus primas a tiempo y en su totalidad y asegurándose de hablar con su médico sobre si el servicio prestado es un beneficio cubierto. También puede evitar las denegaciones retroactivas al obtener sus servicios médicos de un médico dentro de la red.

Si usted o el adulto responsable no pagan la prima obligatoria, para personas que reciben créditos fiscales anticipados para primas, continuaremos pagando todos los reclamos correspondientes por los servicios cubiertos prestados al afiliado durante el primer mes de su período de gracia de tres meses y por los reclamos pendientes por el segundo y tercer mes del período de gracia. Para personas con pólizas emitidas en el estado de Texas y que reciben créditos fiscales anticipados para primas, pagaremos todos los reclamos correspondientes durante todo el período de gracia de tres meses. Informaremos al HHS la falta de pago de las primas, y al afiliado y los proveedores la posibilidad de reclamos denegados. Seguiremos cobrando del Departamento del Tesoro los créditos fiscales anticipados para las primas en nombre de la persona inscrita y devolveremos los créditos fiscales anticipados para las primas en nombre de la persona inscrita para el segundo y tercer mes del período de gracia si la persona inscrita agota su período de gracia como se ha descrito arriba. Una persona inscrita no es elegible para volver a inscribirse una vez que se le haya dado de baja, a menos que tenga una circunstancia especial de inscripción, como un matrimonio o un nacimiento en la familia o durante los períodos anuales de inscripción abierta.

Si usted o el adulto responsable no pagan la prima obligatoria dentro del período de gracia y no recibe créditos fiscales anticipados para primas, es probable que su póliza finalice retroactivamente hasta el último día del mes en el que se pagaron las primas de su cobertura. Si usted es una persona que recibe créditos fiscales anticipados para primas, es probable que su póliza finalice al final del primer mes de nuestro período de gracia. Usted será responsable de pagar cualquier reclamo asociado a los servicios prestados y presentados durante el período de gracia y posterior a cualquier fecha de entrada en vigor de la terminación si este plan termina. Donde lo permita la ley estatal, suspenderemos los reclamos durante el período de gracia y los proveedores pueden llamar a nuestras oficinas para consultar sobre el pago. Les informaremos que los reclamos están pendientes y los proveedores podrán comunicarse con usted por el pago.

Si necesita entender los términos de su plan y el período de gracia de su plan, lo animamos a que llame y hable con nuestro equipo de Servicio al Cliente para describir sus opciones de pago para evitar la terminación de la cobertura.

Apreciamos su negocio y estamos comprometidos a ayudarlo en su trayectoria de atención médica.